Oregon probate law governs estate distribution post-death, emphasizing executor roles in managing and allocating assets according to the deceased's wishes or state law. This process involves legal documentation, asset identification and valuation, heir notification, debt and tax payment, and property transfer. Crafting a comprehensive estate plan under Oregon probate law ensures asset distribution per your desires, including will/trust documents, powers of attorney, and health care directives. Trustworthy Executors and Trustees are vital for accurate will execution and smooth estate distribution, with Oregon law emphasizing organizational skill, financial knowledge, and legal commitment. Tax implications under Oregon probate law must be navigated to ensure fair and compliant asset distribution, with strategies like asset protection plans and trust arrangements. Efficient asset distribution involves meticulous inventorying, tax consideration, and state regulation adherence, facilitated by communication, technology, and dispute resolution methods. Complex assets, including real estate and businesses, are managed under Oregon probate laws for fairness and order among beneficiaries, resolving conflicts and protecting rights.

“Ensuring smooth distribution of estates and assets is a critical aspect of estate planning, especially in Oregon. This comprehensive guide delves into the fundamentals of Oregon probate law, offering insights on creating robust estate plans tailored to individual needs. We explore the process of appointing executors and trustees, navigating tax implications for diverse assets, and distributing them fairly and efficiently. Additionally, we address complex property and business interests, providing essential information for a seamless transition.”

- Understanding Oregon Probate Law Basics

- Creating a Comprehensive Estate Plan

- Appointing Executors and Trustees

- Navigating Tax Implications for Assets

- Distributing Assets Fairly and Efficiently

- Handling Complex Property and Business Interests

Understanding Oregon Probate Law Basics

Oregon probate law outlines the procedures for distributing estates and assets after a person’s death. This includes the appointment of an executor, who manages the estate, and the eventual transfer of property to beneficiaries. Understanding these legal frameworks is crucial for ensuring that the wishes of the deceased are carried out accurately.

In Oregon, the process begins with filing a will or petition in court, followed by the identification of assets, valuation, and the notification of potential heirs. The executor is responsible for administering the estate, paying debts and taxes, and ultimately distributing the remaining assets according to the terms of the will or state law, if there is no valid will. Adhering to Oregon probate law ensures a smooth transition, providing clarity and peace of mind for both the family and the designated executor.

Creating a Comprehensive Estate Plan

Creating a comprehensive estate plan is a crucial step in ensuring the proper distribution of estates and assets, as guided by Oregon probate law. This process involves careful consideration of various factors, such as identifying all assets, documenting ownership, and designating beneficiaries. It’s essential to name executors or trustees who can manage the estate according to your wishes and ensure that tax implications are addressed to minimize potential burdens on loved ones.

A well-crafted estate plan includes a will or trust document that outlines specific instructions for asset distribution. It may also incorporate powers of attorney, health care directives, and other legal tools to provide clarity and avoid unnecessary complications during the probate process. By proactively planning, individuals in Oregon can rest assured that their wishes will be respected, and their assets will be distributed according to their desires after their passing.

Appointing Executors and Trustees

In the context of Oregon probate law, appointing trustworthy Executors and Trustees is paramount for ensuring a seamless distribution process of estates and assets. These individuals play a pivotal role in administering the deceased’s wishes as outlined in their will or trust document. An Executor is responsible for managing the estate, collecting and safeguarding assets, paying debts and taxes, and ultimately distributing the remainder according to legal requirements and the testator’s instructions.

When selecting Executors and Trustees, it’s crucial to consider individuals with strong organizational skills, financial acumen, and a commitment to upholding Oregon probate law. Family members or close friends may be appointed if they possess these qualities and can dedicate the necessary time and effort. Alternatively, professional estate administrators can be chosen for their expertise and experience in navigating complex probate procedures. Either way, the primary goal is to select individuals who will act in the best interest of all involved parties while adhering to Oregon’s legal framework.

Navigating Tax Implications for Assets

Navigating tax implications is a critical aspect of ensuring proper distribution of estates and assets under Oregon probate law. Different types of assets may be subject to varying tax rules, including estate taxes, capital gains taxes, and income taxes. For instance, real estate and investment properties often require careful consideration due to potential capital gains or losses that can impact overall tax liability.

Oregon’s probate laws provide guidelines for managing these taxes, offering strategies such as asset protection plans, gifting, and trust arrangements to minimize tax burdens. It’s crucial for executors and beneficiaries alike to understand the tax implications of each asset to ensure fairness and compliance with state regulations. This proactive approach not only streamlines the distribution process but also helps preserve the value of the estate for intended heirs.

Distributing Assets Fairly and Efficiently

In the context of Oregon probate law, distributing assets fairly and efficiently is a cornerstone of estate planning. A well-drafted will and clear instructions ensure that beneficiaries receive their rightful share in a manner that minimizes legal complications and delays. This process involves meticulous inventorying of assets, careful consideration of tax implications, and adherence to legal requirements set forth by the state.

Efficient distribution requires effective communication between executors, attorneys, and beneficiaries. Utilizing modern technology for record-keeping and asset management streamlines the process, enhancing transparency and accountability. Moreover, Oregon probate law provides mechanisms for resolving disputes amicably, such as informal meetings and mediation, which can significantly reduce the cost and emotional toll associated with lengthy legal battles.

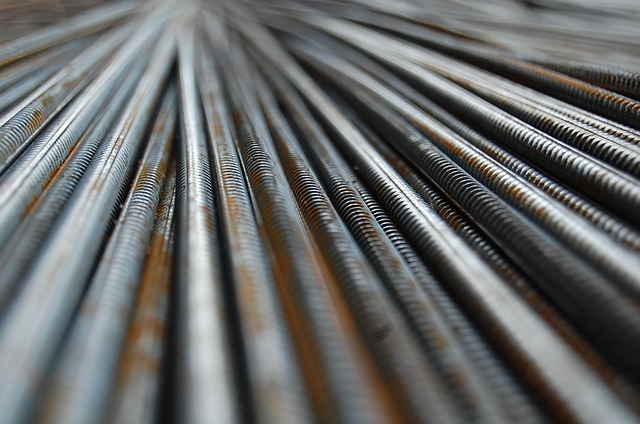

Handling Complex Property and Business Interests

When it comes to handling complex property and business interests in Oregon, probate laws play a pivotal role in ensuring fairness and order. These laws provide a structured framework for managing diverse assets, including real estate holdings, stocks, and ownership stakes in businesses. They facilitate the equitable distribution of these assets among beneficiaries, taking into account any specific instructions or wishes outlined in a will.

Oregon’s probate code is designed to navigate intricate financial landscapes, ensuring that all interests are accurately valued and distributed according to legal requirements. This meticulous approach, guided by Oregon probate law, helps resolve potential conflicts and protects the rights of all parties involved, especially when dealing with valuable business enterprises or substantial real estate portfolios.